|

SEPTEMBER 2012 |

|

|

|

| Home | | |

Feature | | |

Innovation | | |

| |

| |

| |

Legacy |

| Currently viewing: Feature / Next: Innovation |

Recovery & Growth |

FEATURE |

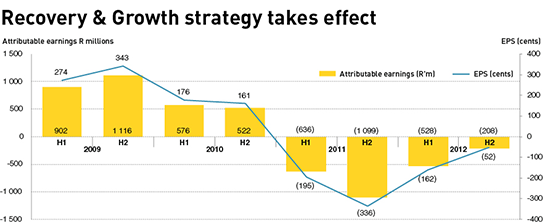

In July 2011, Murray & Roberts chief executive, Henry Laas and his executive team launched a three-year Recovery & Growth strategy to mitigate the impacts of the sustained economic recession and other challenges faced by the Group and to prepare the company for growth. A year later, Murray & Roberts has addressed the immediate challenges during its Recovery year to June 2012 and is now shifting its focus to the next two Growth years to place the Group on a new strategic path. The first phase of the Recovery & Growth plan was implemented to re-energise and realign Murray & Roberts, to restore financial stability and to enhance operational focus. This was achieved through the development of a new purpose, vision and values. Financial stability was restored with the successful restructuring of the Group’s South African term debt in November 2011 and the implementation of a R2 billion rights offer which was successfully closed out in April 2012. At the same time, Group operations were reorganised into five operating platforms and executive and operational leadership teams were strengthened, particularly in the Construction Africa and Middle East operations. Disposal of non-core assetsCorporate overheads were reduced and the process of disposing of non-core businesses was put into action: Clough’s marine construction business in Australia and Johnson Arabia and BRC Arabia in the Middle East were sold in the year to June 2011, while Cisco and the balance of the Steel Business were sold in two separate transactions concluded in August 2012. Resolution of challenges on major contractsThere has also been progress in the resolution of issues on three major projects, which have had a significant financial impact on Murray & Roberts in recent years. An amicable “global” settlement was reached between the Medupi Power Station Joint Venture and Eskom in July 2012 which resolves all commercial issues encountered to date on the Medupi civils contract. This includes the negotiation of a revised programme and tender value to completion of the project. “We are not aware of any new information that challenges our entitlement on the claims associated with these major projects but we are frustrated by the slow process,” says Laas. “Our target is to have all of these claims resolved by December 2014.” The loss-making Gorgon Pioneer Materials Offloading Facility (GPMOF) marine project in Western Australia was completed in July 2012 and the project has been fully demobilised. Murray & Roberts achieved an important breakthrough when the arbitration on the principle of design changes ruled in its favour. Resolution on the value for design changes claim is now underway. “We are not aware of any new information that challenges our entitlement on the claims associated with the above three projects, but we are frustrated by the slow process,” says Laas. “Our target is to have all of these claims resolved by December 2014.” A new strategic futureThe focus has now shifted to the implementation of a growth strategy which will, over the next two years, shape Murray & Roberts into a business with a stronger focus on its core competencies of construction and engineering, and better align the Group to markets that have been identified as the main growth nodes of the future. Positioning for the growth phase commenced concurrent with the recovery phase, and its starting points were the preparation of the Group’s leadership team and operational structure for a new era.

At the heart of Murray & Roberts’ growth strategy is the rebuilding of its core competencies and a strong focus on infrastructure development primarily in the mining, oil & gas, power, water and industrial markets. With the domestic construction market in the doldrums, the lion’s share of future growth will be generated in international markets. Already the Group’s project order book, which amounted to R45 billion at 30 June 2012, has a heavy international weighting, while more than 50% of group earnings are generated in the oil & gas and mining sectors. Three of the Group’s five operating platforms present strong future growth potential. These are Construction Global Underground Mining, Construction Australasia Oil & Gas, and Engineering Africa.

The Construction Global Underground Mining platform, which combines Murray & Roberts’ mining activities in Africa, Australia, Canada and the USA, has been a valued contributor to the Group’s revenue and profits and its positioning in global mining economies make it a central player in the growth plan. The Group has diversified its exposure to commodities to reduce its historic dependence on platinum and has an established presence in the South American market, which offers significant future growth potential from Chile’s copper mines. The Engineering Africa operating platform, which includes Murray & Roberts Projects, Wade Walker, Concor Engineering and Genrec, is gearing up for opportunities in the power and water sectors as demand for renewable energy and potable water grows at unprecedented levels. Murray & Roberts plans to strengthen its position in the water treatment market with a strategic acquisition and the Group recently secured a significant water treatment project at one of Gold Fields’ mines in Ghana. In the power market, Murray & Roberts is participating in Government’s IRP2010 renewable energy programme and is positioning itself as a subcontractor to technology owners to establish power-generating facilities and develop the infrastructure associated with power projects. The Group will also leverage its experience in operations and maintenance to provide support in this area of the power value chain. Creating a high performance organisationMurray & Roberts has invested significant resources in re-energising and uniting its people and operating platforms, supported by its values of care, accountability, commitment, integrity and respect for others. A recent initiative to strengthen unity has been the development of Skeen Boulevard into a Murray & Roberts Campus which, in time, will group all of the operating businesses in one location. Another recent initiative to reinforce efforts to create a high performance culture has been the introduction of performance contracts for executives and senior managers in the past financial year. These will be extended to other levels of the organisation during the course of the new financial year. One of the most important achievements of the 2012 financial year has been the reduction in the number of employee fatalities to four, compared to 12 fatalities in 2011 and 10 in 2010. While the Group continues to strive for Zero Harm, this declining trend has contributed to a lifting of employee morale and it signals the embedding of the Group’s core values. This must surely bode well for the future. |

|||||||||||||||||||||||||

Copyright © 2012, Murray & Roberts. All Rights Reserved

“At the end of this process, we expect that the Group will be more clearly aligned to our pre-identified focus areas and our revenue base will be more globally diversified, although we will continue to respond to construction opportunities in the domestic market.”

“At the end of this process, we expect that the Group will be more clearly aligned to our pre-identified focus areas and our revenue base will be more globally diversified, although we will continue to respond to construction opportunities in the domestic market.”